While many are familiar with traditional investment types such as bonds, cash, real estate, and stocks – there are other asset classes available. One of these alternative investment options is known as Managed Futures.

By definition, Managed Futures is an alternative investment type where trading in the futures markets is managed by another person or entity instead of the individual that owns the account. These account managers are known as Commodity Trading Advisors (CTAs) or Commodity Pool Operators (CPOs). Both CTAs and CPOs are regulated individuals, registered with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA).

Different than a traditional money manager, the CTAs and CPOs will trade their client’s account in a diversified portfolio that may contain both traditional and alternative investment types. The money managers will take a market position when they feel that the opportunity for profit outweighs the risk of the trade.

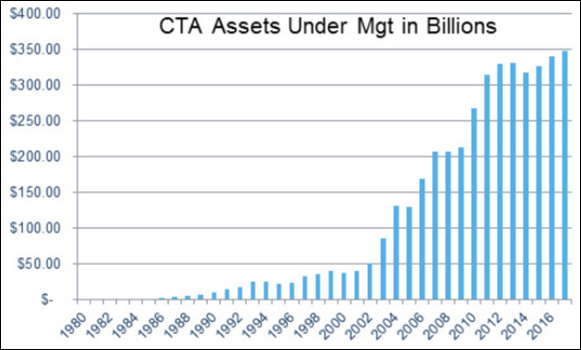

According to data provided by the Chicago Mercantile Exchange (CME Group), assets under management (AUM) has recently surpassed $348 billion over the past few years, growing significantly over the past several decades from under $10 million in the 1980s.

If an investment in managed futures is of interest to you, you may also have interest in familiarizing yourself with World Cup Advisor (WCA) and the services we can provide. Through our World Cup Trading Championship® events and diligent search processes, WCA connects you with the some of the world’s top traders that put their own money on the line to demonstrate to you just what they have to offer. All performance of our traders is available for you to review prior to making your investment decision – including their trade-by-trade track record. You are in control – you get to pick the trader that you feel best aligns with your goals and when they place a trade, your account will take the same trades at the same time automatically.

Not sure if you’re ready to commit to a WCA account just yet? Take advantage of our FREE guest membership today and analyze traders’ performance until you’re ready! Or, if you have more questions – we’re happy to answer them.

Trading futures and forex involves significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results. This web site is intended as a solicitation for leader-follower AutoTrade programs offered by WorldCupAdvisor.com (WCA). There is unlimited risk of loss in selling options. An investor must read, understand and sign a Letter of Direction for WCA programs before investing. There are no guarantees of profit no matter who is managing your money. Net-profit data wherever displayed on WCA includes open trade equity if any as of market close on the date listed, and is calculated using current WCA subscription rates, standardized commission rates (includes estimated Exchange, Clearing and Transaction fees per round turn. The actual amount of fees may vary with each specific futures contract traded but not NFA fees) and funding requirements available through any authorized AutoTrade broker. For detail on commission calculations, open the Net-Profit Calculator. Trades displayed on WorldCupAdvisor.com are from proprietary accounts that are either owned by the advisor or are entities of which the advisor is a beneficial owner. Performance data shown for lead accounts is not necessarily indicative of subscriber rate of return and drawdown due to execution, slippage, subscriber funding level and other factors.