There are numerous ways to analyze the performance of a trade, commingled fund, or investment account. One technique is to perform an examination that takes into account the monthly or yearly total return, along with any dividends as well as income plus capital appreciation. One could also incorporate a risk-adjusted measure such as the Sharpe Ratio into the analysis. A simple yet effective method of analyzing an investment’s performance is the value-added monthly index or VAMI. This method tracks the compound return on any investment over a given period, often calendar months or years.

The main idea behind VAMI is to display how a starting dollar amount, usually $1,000, would have grown over a certain period of time. The calculation assumes reinvestment (i.e., not withdrawing funds at any point) and is usually net of all fees and expenses. For example, assume one invested $1,000 on January 1st, and the investment returned 5% during that month. On February 1st, the $1,000 investment would now be worth $1,050.

How is VAMI Calculated?

Mathematically, the calculation behind VAMI is straightforward. You begin with the initial investment amount, usually $1,000, and multiply it by the rate of return (RoR) plus 1. This gives you the initial calculation of VAMI. In subsequent calculations, the previously calculated value for VAMI is multiplied again by 1 + the RoR. Visually, it appears as follows:

VAMI Calculation

VAMI (Initial) = 1,000 x (RoR + 1)

VAMI (Ongoing) = Previous VAMI x (RoR + 1)

RoR = Rate of Return for the period

What Sets the VAMI Apart?

Whereas other measures of investment performance, such as the aforementioned Sharpe Ratio, are more mathematical and less descriptive, VAMI is highly intuitive, and it shows an investor how much a hypothetical $1,000 investment has grown over time. Due to VAMI standardizing an investment based on a single hypothetical investment, it is relatively easier to understand than other metrics.

Another attractive aspect of VAMI is when it is used as a comparison tool. Visually, it is easy to compare the growth of different investments to each other, irrespective of whether those investments are stocks, hedge funds, benchmarks, or CTAs. This allows one to analyze investments across different asset classes, as well as comparison benchmarks, providing a broad, 30,000-foot view of investment performance.

VAMI is also useful to track an account – a futures brokerage account, for instance – where an investor needs to determine performance independent of any additional withdrawals or deposits that could affect the net liquidating value. For instance, let us imagine that a trader started the month with a $10,000 account and ended the month with $13,000. On the 15th of the month, that trader deposited an additional $1,500 in the account. By simply analyzing the starting and ending balance of the account, we might mistakenly conclude that the trader earned 30% that month – $13,000 – $10,000 / $10,000.

We would be wrong because a large portion of the increase in account value – exactly half, to be precise – came from the $1,500 deposit on the 15th. VAMI is a great tool because it assumes a starting balance of $1,000 without any additional deposits or withdrawals and bases its analysis purely on the profit or loss of the underlying strategy.

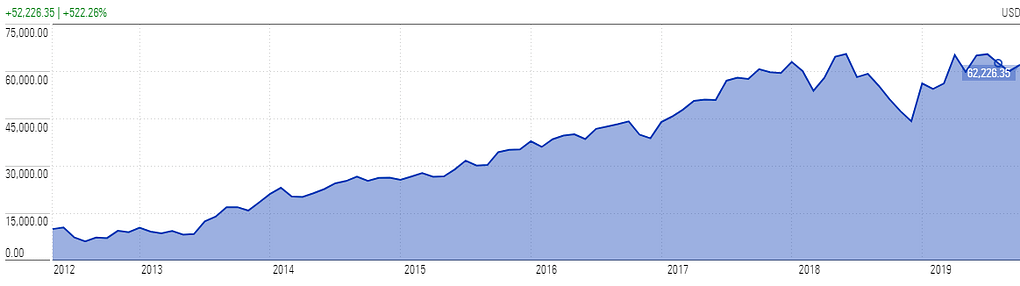

The following graphic shows a VAMI for a hypothetical stock. Please note this particular version starts with a hypothetical $10,000 investment – not the $1,000 referred to above – but the principles are the same:

Since the inception of the aforementioned hypothetical stock’s IPO, the stock has returned 522.26% cumulatively, resulting in a $62.2K value on the initial $10,000 invested. Not a bad return, to be sure, and we can see visually that the VAMI continues to increase over time beginning in the middle of 2013.

Limitations of the VAMI

There are a few drawbacks associated with the VAMI. First, when presented in a linear fashion, it can be difficult to discern the acceleration or deceleration of the rate of return on the investment. For instance, the VAMI may show positive performance – generally traveling from the lower left to the upper right – but in real terms, performance may actually be decreasing from period to period. For instance, let us say that annual returns for a given trading account were as follows:

2015: +12%

2016: +11.2%

2017: +9.6%

2018: +3.4%

The VAMI would still show generally positive performance, e.g., compound growth of the hypothetical $1,000 over time, but it would fail to show that with each calendar year that has passed, the trading account has done worse in terms of total, absolute performance. This drawback is not material in the sense that it nullifies or invalidates the usefulness of the VAMI metric, but it is something to keep in mind when analyzing an investment’s overall performance.

Overall, the descriptive power and the simplicity of the VAMI are attractive features of the metric. It is also a commonly cited metric, which makes it easy to find and compare with other investments of like nature (stocks, funds, trading accounts, etc.). The VAMI should be included in any investor’s financial toolkit when analyzing investment performance.

The information provided in the WCA Education Center does not, and is not intended to, constitute financial advice and all information, content, and materials available in the WCA Education Center are for general informational purposes only. This information may not constitute the most up-to-date information. The WCA Education Center may contain information from or links to other third-party websites. Such links are only for the convenience of the reader, user or browser; World Cup Advisor and its affiliates do not recommend or endorse the contents of any third-party sites.

Trading futures and forex involves significant risk of loss and is not suitable for everyone. Past performance is not necessarily indicative of future results.